will county illinois property tax due dates 2021

Will County is located in the northern part of Illinois and is one of the fastest-growing counties in the United States. Tuesday March 1 2022.

Cook County First Installment Property Tax Bills Due March 1 2022 Village Of Barrington Hills

In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced alternate deadlines and methods to pay property taxes.

. Tuesday March 2 2021. First Date for Filing a Petition for Tax Deed. 3 as the due dates for 2021.

Illinois has one of the highest average property tax rates in the. Late Payment Interest Waived through Monday May 3 2021. Half of the First Installment is due by June 3 2021.

Click Here for the List. Any payment received on June 2nd or after will accrue penalty at an interest rate. My name andor mailing address is wrong on my tax bill.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. The county seat of Will County is Joliet. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500.

Property tax bills mailed. The Countys property tax offices recently announced an extended due date until October 1st. Tax Year 2020 Second Installment Due Date.

Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due. Welcome to Property Taxes and Fees. Tax amount varies by county.

It is important to maintain the countys tax cycle to ensure revenues are available to continue critical services for our residents. June 3 2021. The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of. Will County collects on average 205 of a propertys assessed fair market value as property tax.

December 17 2021 tallment additional 15 every 30 days Last day to pay property taxes with December 23 2021 a personal check Must be cash cashier check or money order after this date December 21 2021 Delinquent Certified Letters Mailed January 14 2022 Publication cut off date. Friday October 1 2021. 2021 payable 202 property tax due dates.

Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. Banks Begin Taking Payments for 2021 Levy RE. Mobile Home 50 Late Penalty Assessed.

Inquire real estate tax information. Last day to pay property taxes without the 1000 publication fee. August 20 2021 reporting sales made in july 2021.

Real Estate First Installment Due. This installment is mailed by January 31. Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due.

In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced alternate deadlines and methods to pay property taxes. In Cook County the first installment is due by March 1. Will County Treasurer Tim Brophy said the board should establish June 3 Aug.

Home Genel illinois property tax due dates 2021. Chicago Street Joliet IL 60432. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

If the due date falls on a weekend or holiday your payment is due the next business day. It is important to maintain the countys tax cycle to ensure revenues are available to continue critical services for our residents. The Illinois income tax rate is 495 percent 0495.

Taxpayers affected by the severe weather and tornadoes beginning December 10 2021 have been provided with an extension of time to file their 2021 IL-1040 until May 16 2022. 2021 Real Estate Tax Calendar payable in 2022 May 2nd. The remaining half of the First Installment is due by August 3 2021.

Mobile Home Delinquent Notices Sent. While taxes from the 2021 second installment tax bill which reflect 2020 assessments are usually due in August the due date was postponed until October 1st. First Installment Due.

The First Installment of 2021 Levy Real Estate Taxes is due on June 1 2022. Last day to submit changes for ACH withdrawals for. The balance is calculated by subtracting the first installment from the total taxes due for the present year.

Tax Year 2020 Second Installment Due Date. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. A delinquent tax list will be published after the second due date.

1st Distribution to Taxing Bodies 2021 Levy. Find out more. The due date for filing your 2020 Form IL-1040 and paying any tax you owe is April 15 2021.

Brophy is encouraging all residents to use one of the alternate methods to pay taxes rather than come to the office and waiting in often long lines. The first installment of cook countys 2021 property taxes are now available online for payment. The Online Property Inquiry tool updates every hour to reflect the most recent payments.

Tax Year 2021 First Installment Due Date. To subscribe to or unsubscribe from this property tax due date reminder enter email and press Opt-InOut button. Illinois property tax due dates 2021.

Payment information amount due dates who to pay etc Due to COVID-19 the 2021 open book meetings will be. For more information see press release. 30 rows Real Estate Property Tax Bills Mailed.

Tax Year 2020 First Installment Due Date. 173 of home value. Will County Treasurers Office.

Founded in 1836 today Will County is a major hub for roads rail and natural gas pipelines.

Property Tax Bill City Of Racine

Property Tax Prorations Case Escrow

Property Tax City Of Decatur Il

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

A Breakdown Of 2022 Property Tax By State

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

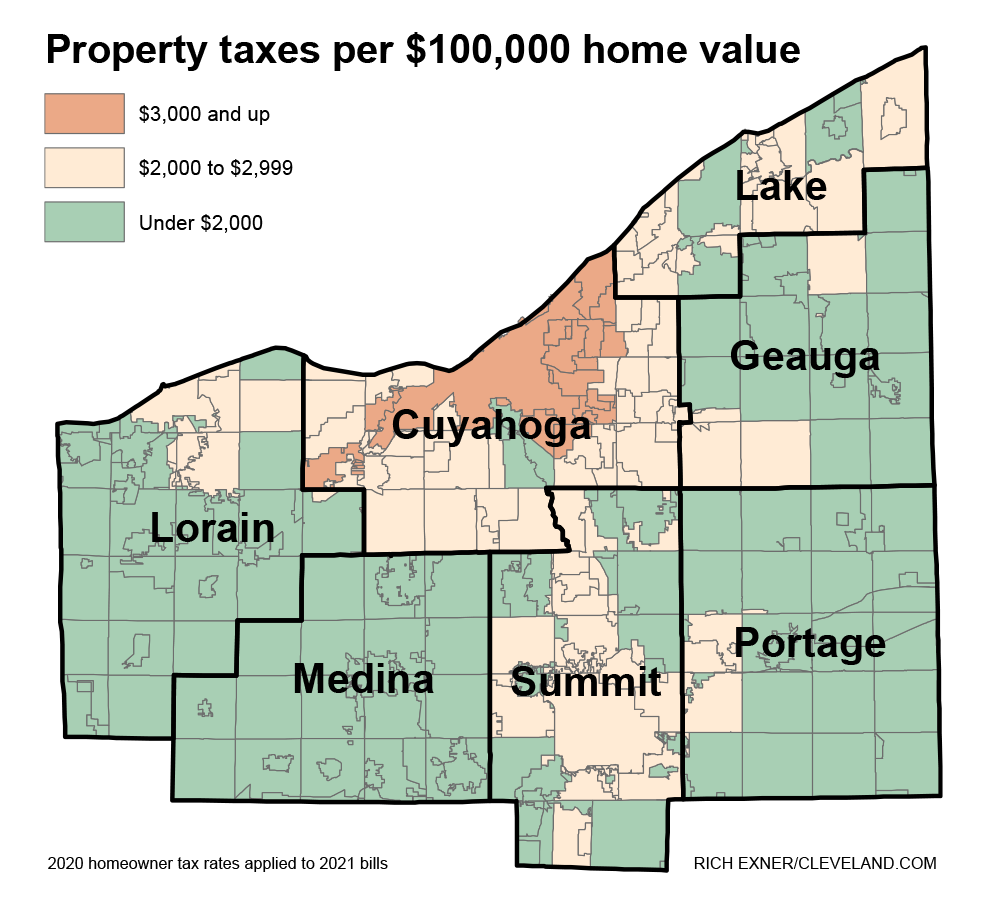

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Property Taxes Calculating State Differences How To Pay

Real Estate Property Tax Jackson County Mo

Property Tax City Of Decatur Il

Pin By Zoe Murphy On Olivia Rodrigo Drivers License Listening Streaming

North Central Illinois Economic Development Corporation Property Taxes

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)